10 Big Ideas in Web3 for 2026: DePIN, AI Agents, Tokenization & More

Discover the 10 biggest Web3 trends for 2026-2026: DePIN networks, AI agents with crypto wallets, asset tokenization, stablecoins, and rollup-centric.

Keep Learning: Related Web3 Career Guides

These big ideas are creating massive career opportunities. Explore roles that align with your interests:

- [AI & Web3 Engineering Careers](/ai-and-web3-engineering-careers) - Build AI agents and autonomous systems

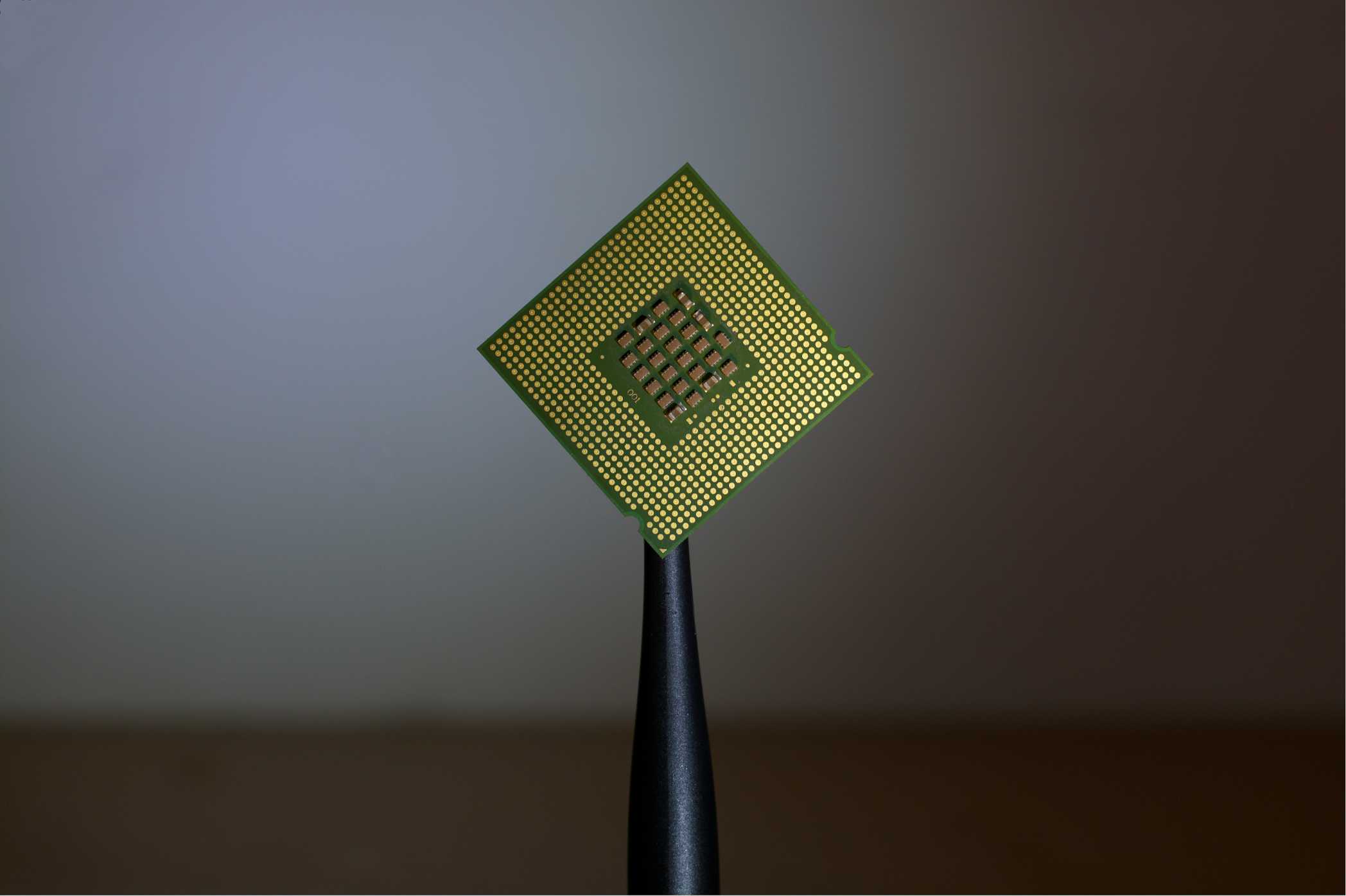

- DePIN Infrastructure Engineer - Physical infrastructure networks

- Smart Contract Developer Guide - Core blockchain development

- Web3 Product Manager Careers - Lead innovative Web3 products

- Full-Stack Web3 Developer - Build complete dApp solutions

- [Web3 Salary Calculator](/salary-calculator) - Estimate earnings in emerging roles